Steps to Add CA on Income Tax e-Filing Portal

The assessee who is subject to tax audit as per the income tax act should add the appointed CA from the income tax e-filing account. Once the assessee will add CA from the account on the income tax e-filing portal, the CA can upload the Tax Audit Report.The steps to add CA on Income tax e-filing Portal are as below:

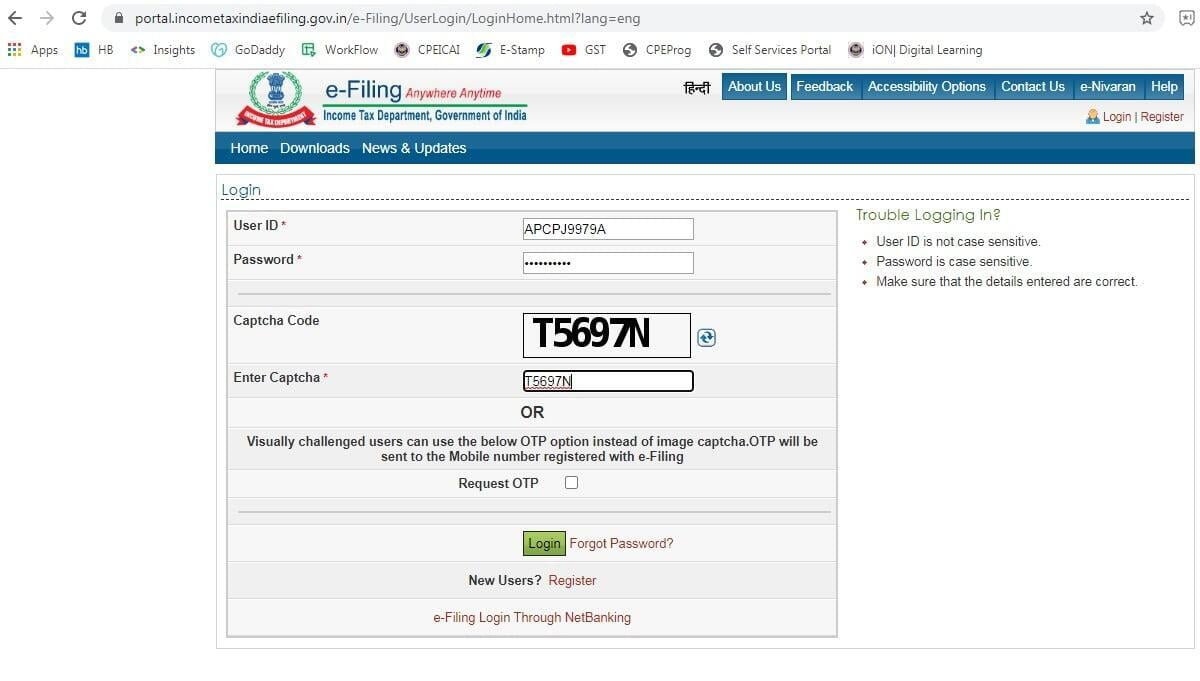

1. Login to Income Tax Account

Login to the income tax e-filing portal using valid username and password.

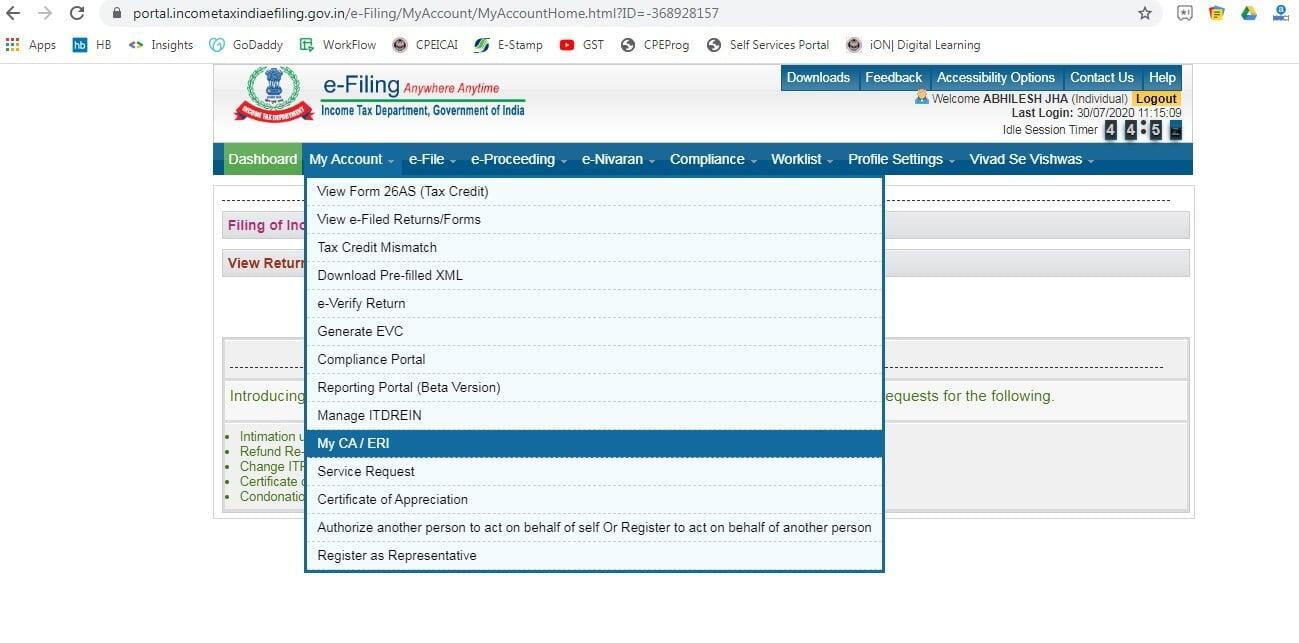

2. Go to My Account then click My CA

Remember to fill up entire details in your income-tax portal. Like Present address, complete permanent & Temporary address, all email address and mobile numbers, and most important of all do not forget to mention your updated bank details. Most of the times we have seen that people complaining about their refund not reaching them on time, or getting returned or hitting wrong bank accounts.

To avoid these silly mistakes, make sure you are updating your Income Tax portal from time to time.

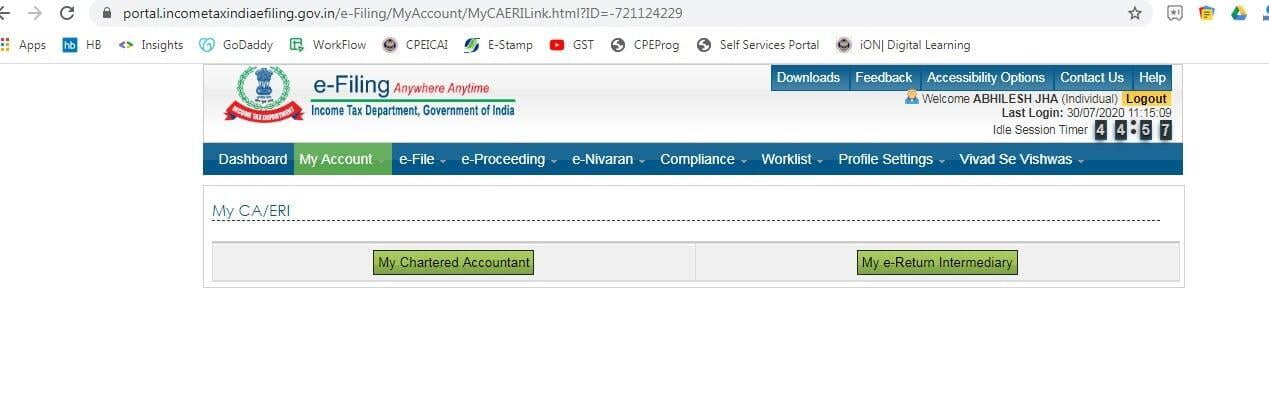

3. Click My Chartered Accountant

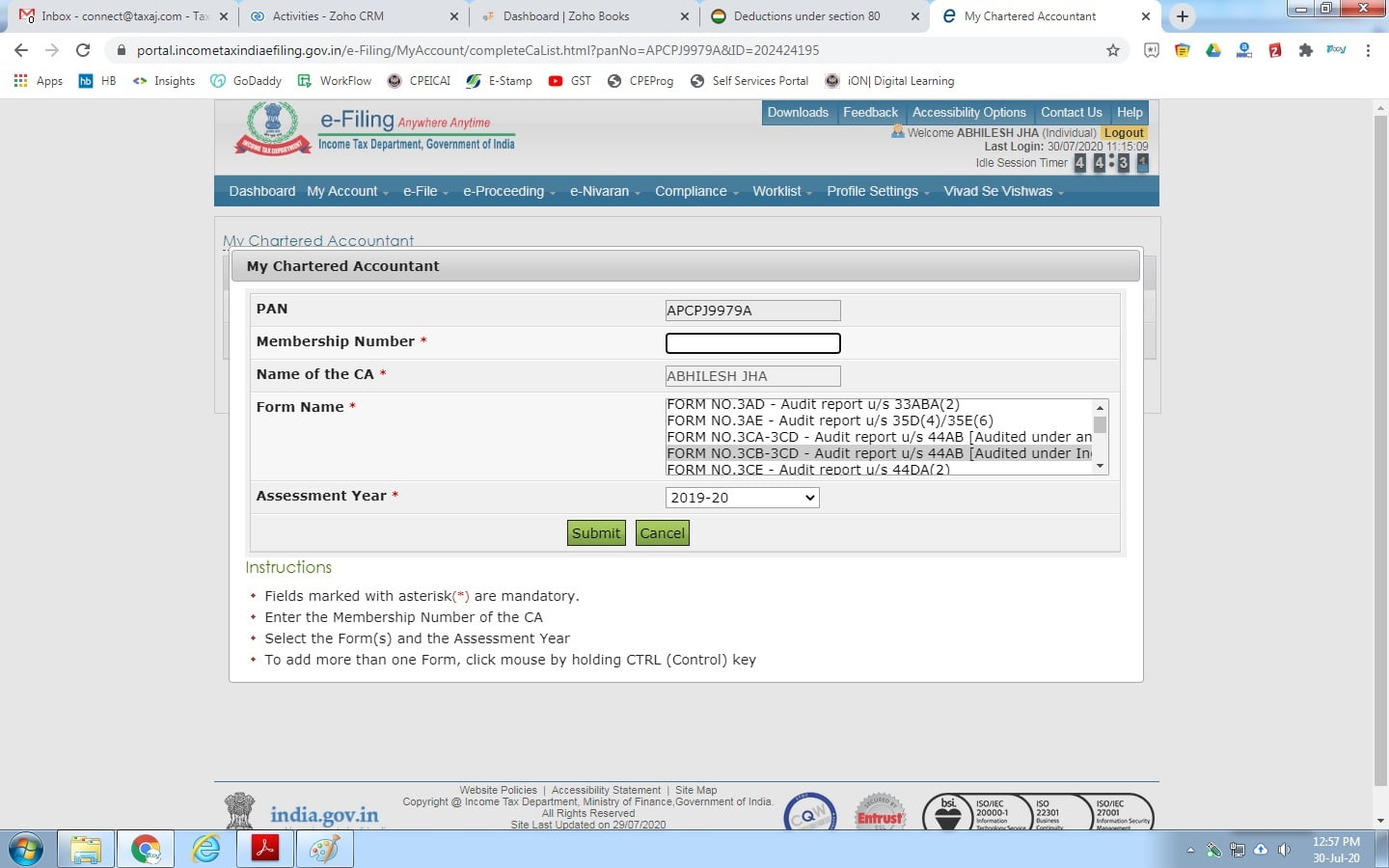

4. Add Form details and Membership details

Click on Add and enter the following details:

a. Enter the membership number of CA( It will be a 5 or 6 digit number)

b. Select Form Name from drop-down list. (Please confirm it with your CA Before filing)

c. Select Assessment Year from drop-down list (Make sure you know the difference between Financial Year and Assessment year)

d. Click on Submit.

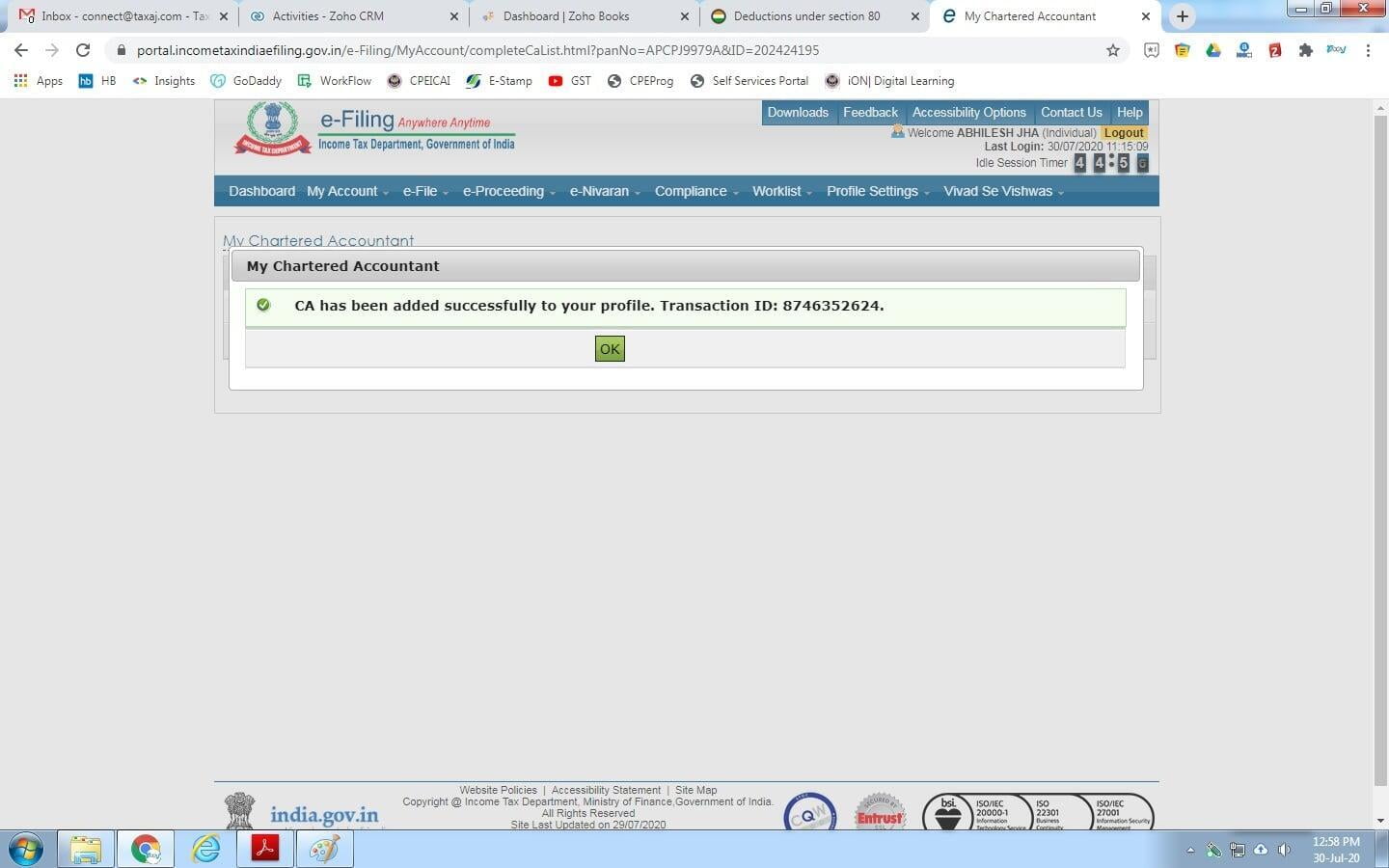

5. Click OK Button.

On successful completion of task. You will receive a Green tick with confirmation message. If anything is error there will be a red mark with mentioned instructions to do so.

If you are facing any difficulty, feel free to get in touch with our team or can search the knowledge base by entering your question in our chat session.