Challan 280 is one way to pay your advance tax, regular assessment tax, self-assessment tax, additional charges etc. online. Let’s discuss how.

The Tax Payment through Payment Gateway option is available to all taxpayers on the e-Filing portal www.incometax.gov.in. With this service, you can make tax payment online (in pre-login or post-login mode) by using Payment Gateway which enables you to make tax payment through Credit Card, Debit Card, Net-banking and UPI. The selected payment gateway will redirect to its own page and provide all the options available with that gateway. The transaction charges as per Annexure 1, will be applicable over and above the tax amount in this mode.

2. Prerequisites for availing this service

You can make Tax Payment using “Payment Gateway” in Pre-login (before logging in the e-Filing portal) or post-login (after logging in the e-Filing portal) mode.

Pre-Login:

- Valid PAN/TAN for which tax payment has to be made;

- Debit Card / Credit Card / Net banking facility / UPI; and

- Valid Mobile number to receive One Time Password.

Post-login:

- Registered user in the e-Filing portal www.incometax.gov.in

- Debit Card / Credit Card / Net banking facility / UPI

Important Note: As of now, the tax payment on e-Filing Portal (e-Pay Tax service) through Payment Gateway mode is available through Four [DJ1]

3. Step-by-Step Guide

3.1. Pay after generating a New Challan Form (CRN) – Post-Login Service

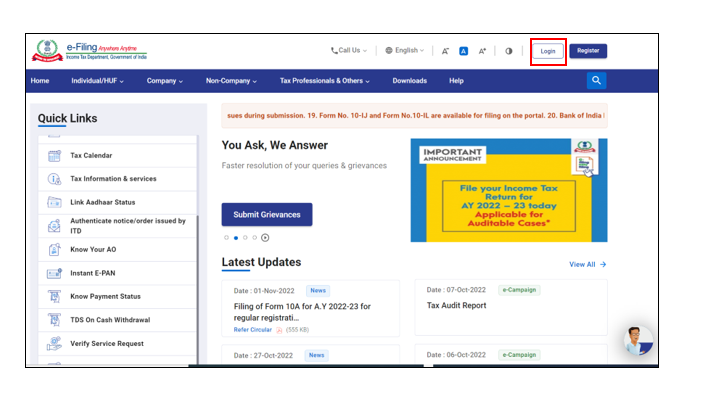

Step 1: Log in to the e-Filing portal with your User ID and Password.

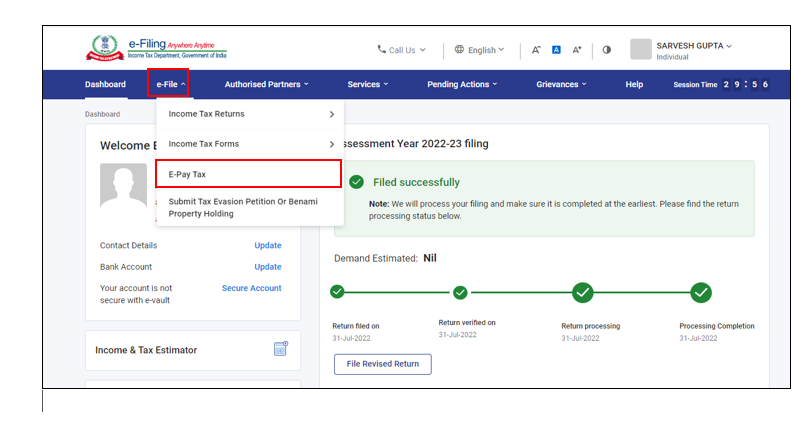

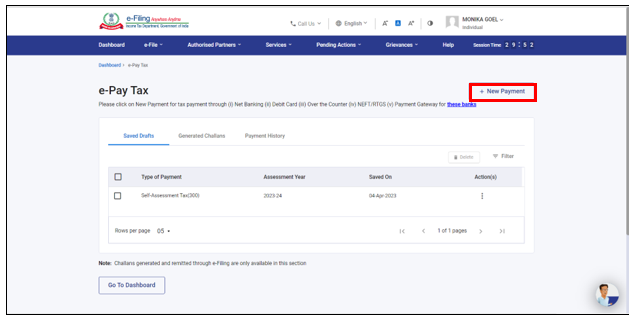

Step 2: On the Dashboard, click e-File > e-Pay Tax. You will be navigated to the e-Pay Tax. On the e-Pay Tax page, click the New Payment option to initiate the online tax payment.

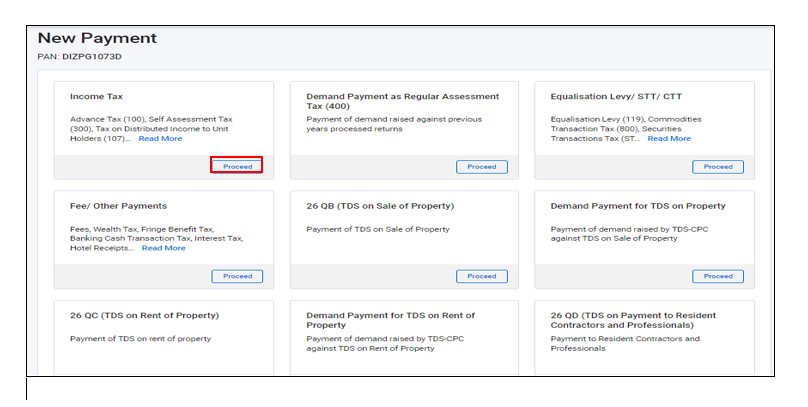

Step 3: On the New Payment page, click Proceed on a tax payment tile applicable to you.

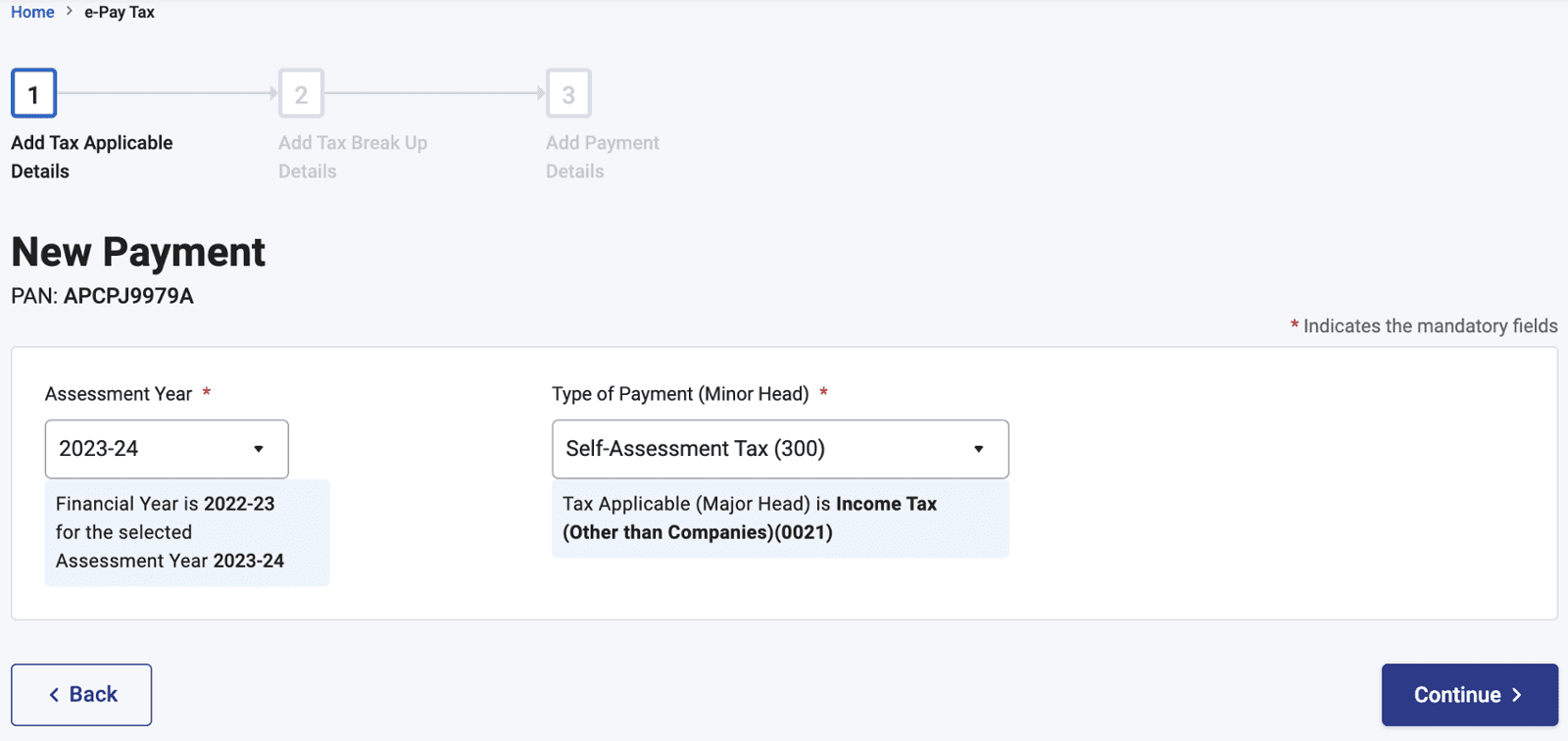

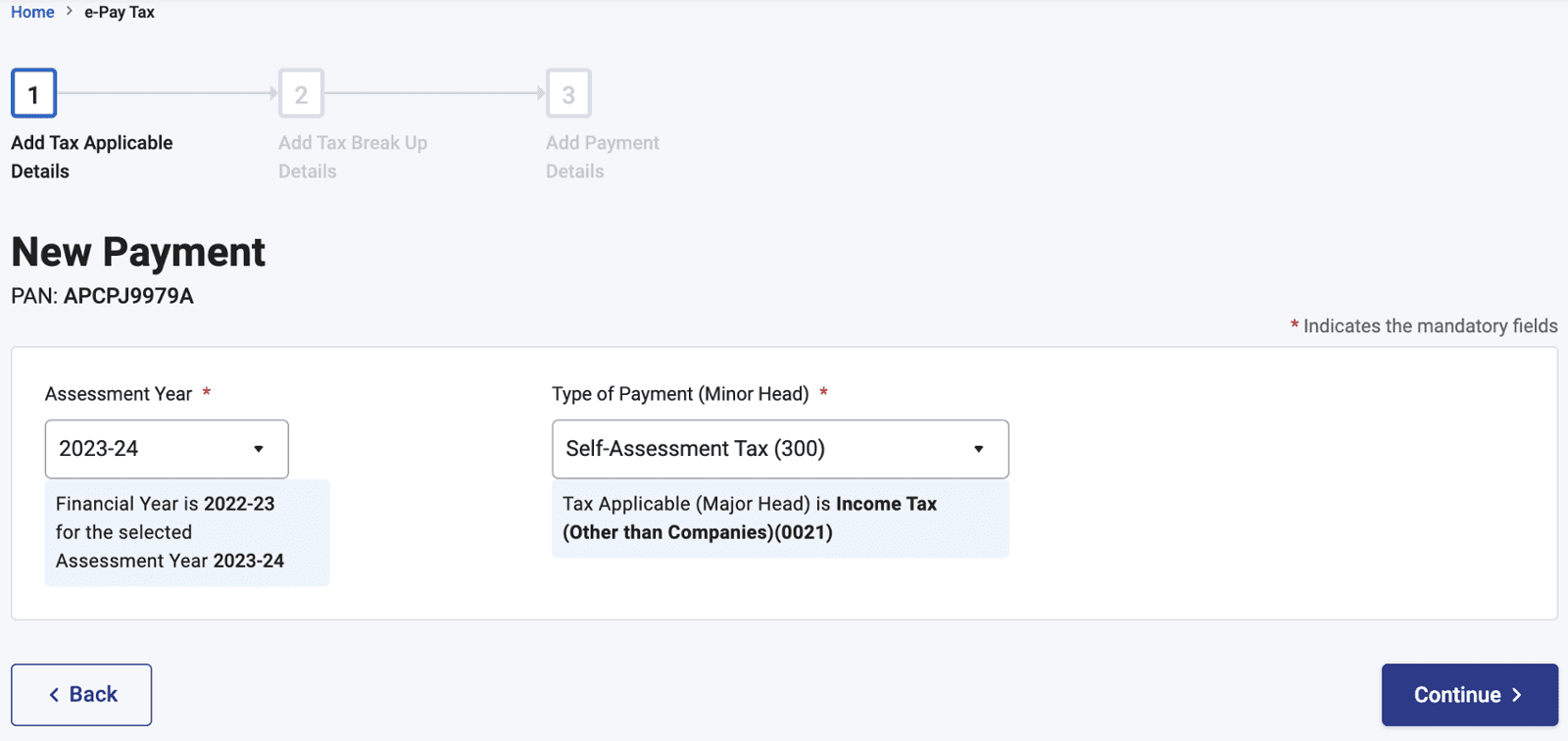

Step 4: After selecting the applicable Tax Payment tile, select Assessment Year, Minor head, other details (as applicable) and click Continue.

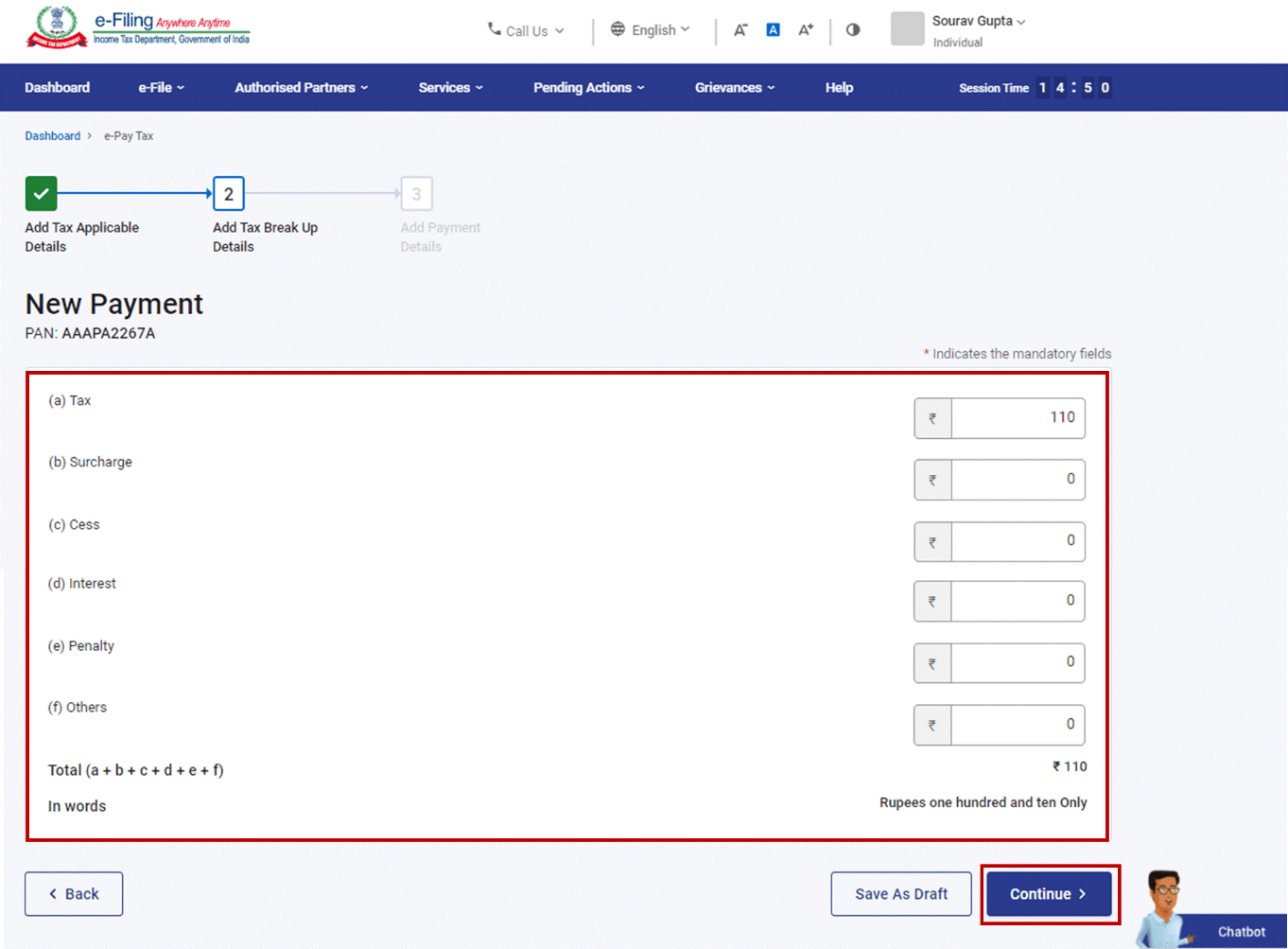

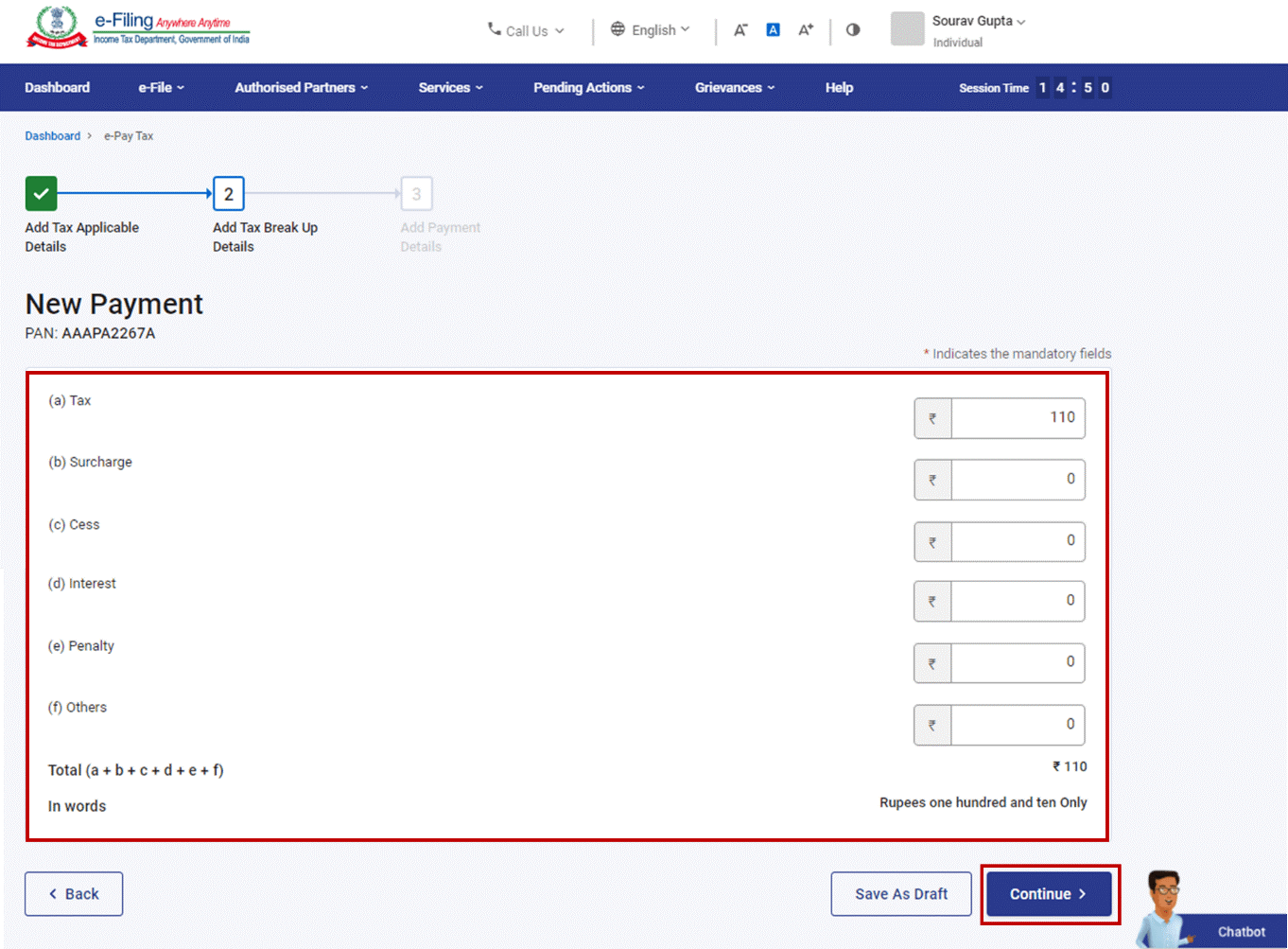

Step 5: On the Add Tax Breakup Details page, add the breakup of total amount of tax payment and click Continue.

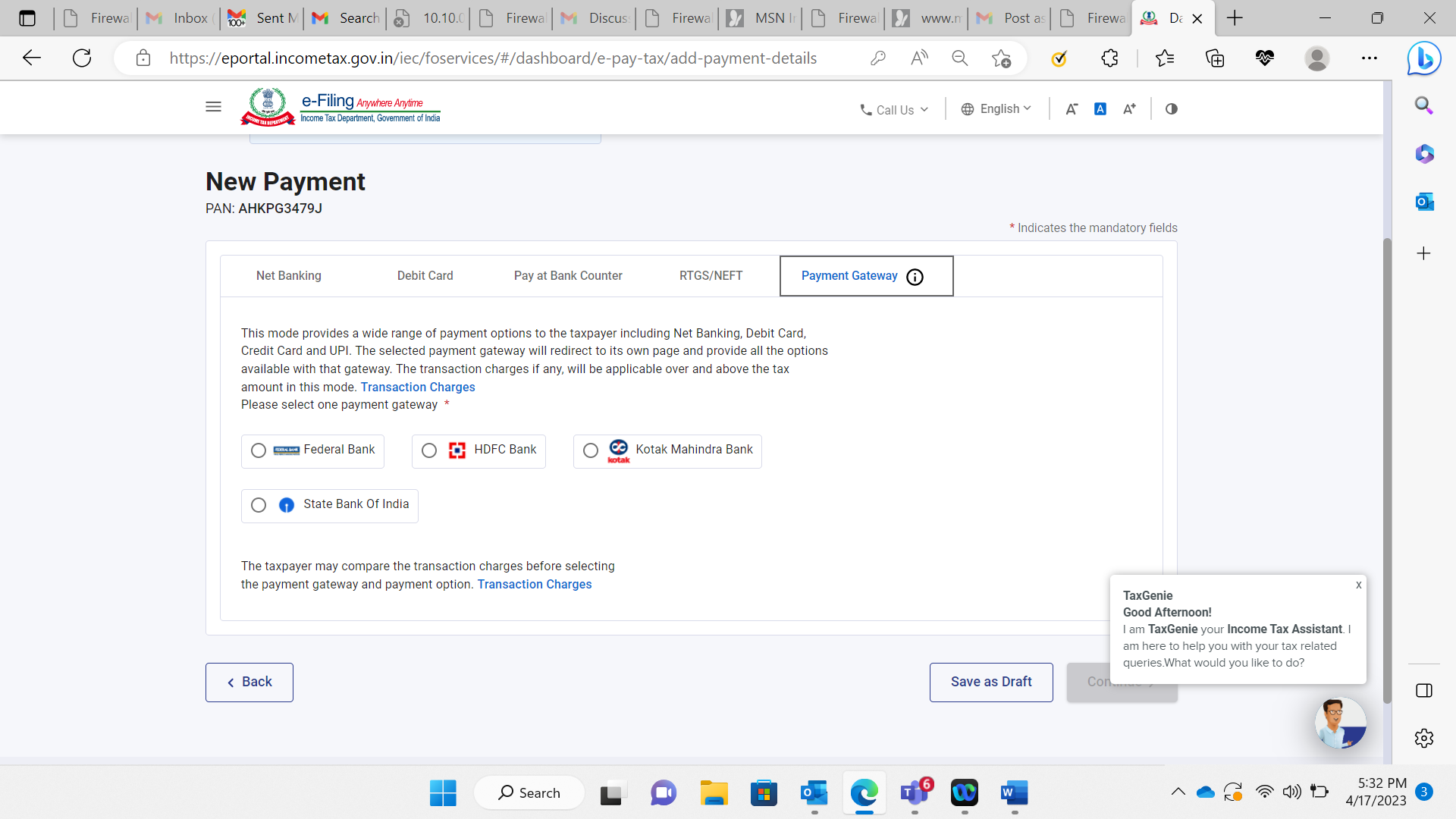

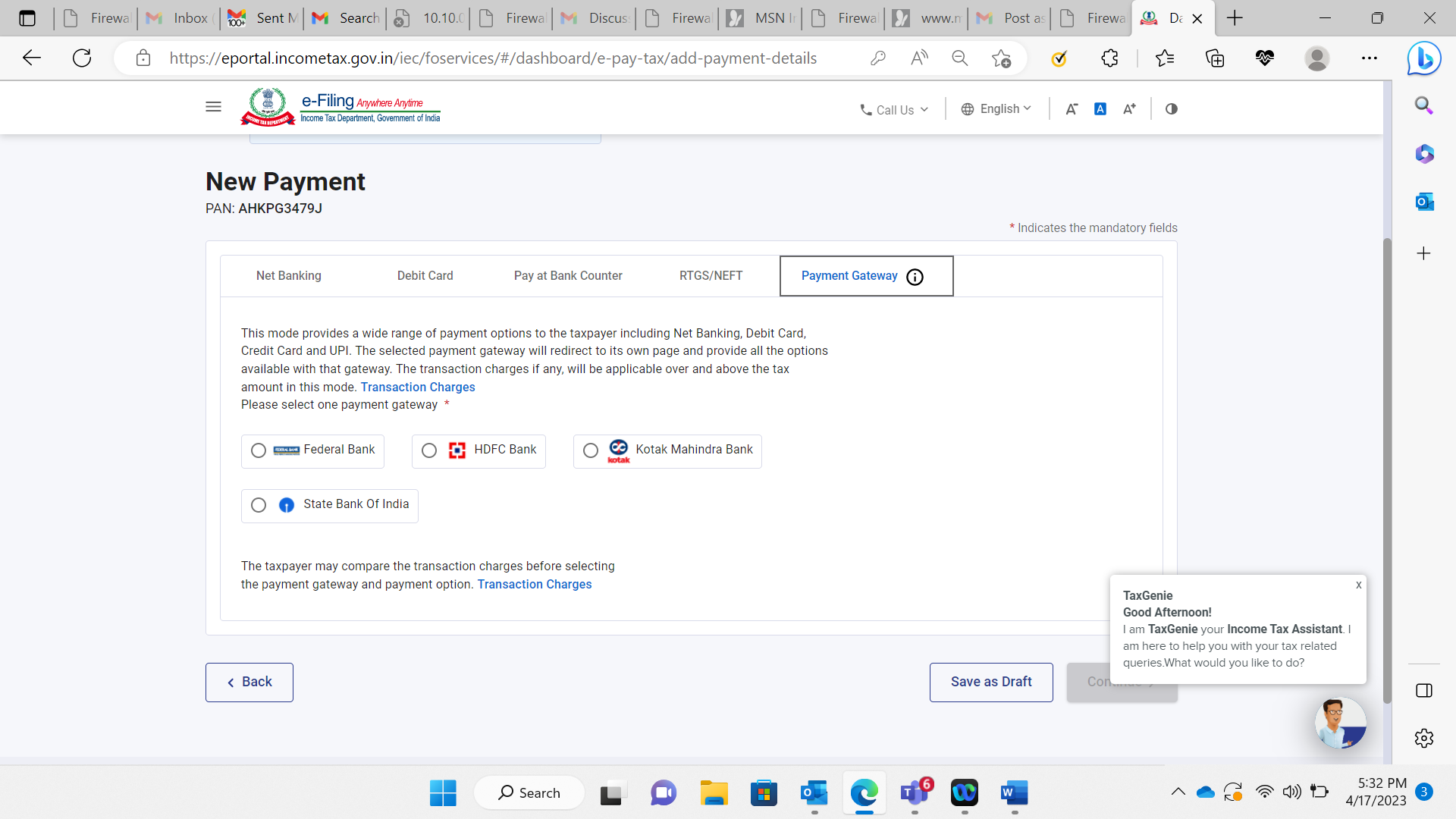

Step 6:

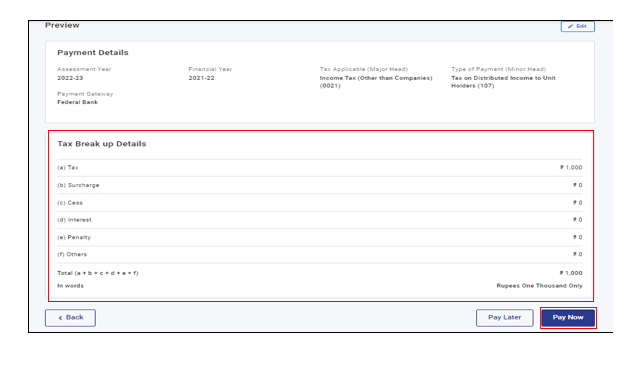

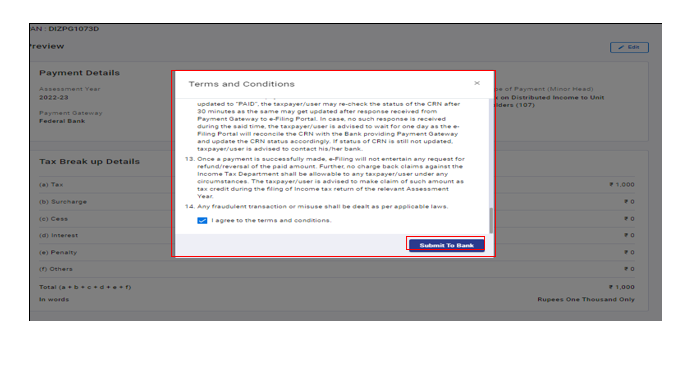

Step 7: In the Preview and Make Payment page, verify the details and tax break up details and click Pay Now.

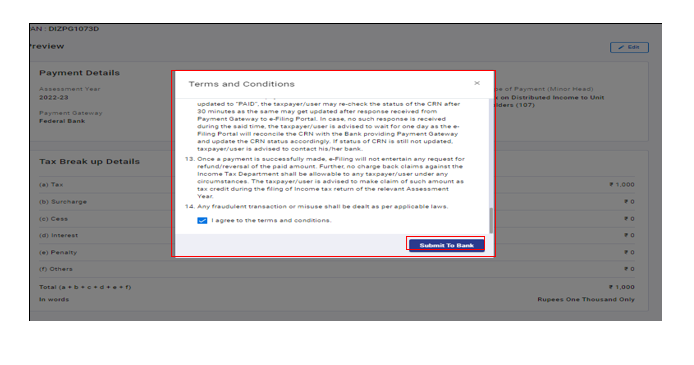

Step 8: Read and Select the Terms and Conditions and Click Submit to Bank. (You will be redirected to the website of Payment Gateway where you can login or enter Net Banking/ Debit / Credit Card / UPI details and make the payment). You may compare transaction charges (as per Annexure 1) of the five payment gateways before selecting the payment option.

Note: After successful payment, you will receive a confirmation e-Mail and an SMS on the e-Mail ID and Mobile number registered with the e-Filing portal. Once the payment is successful, details of payment and Challan Receipt are available under Payment History Tab on the e-Pay Tax page.

3.2. Pay without logging in to the e-Filing portal – Pre-Login Service

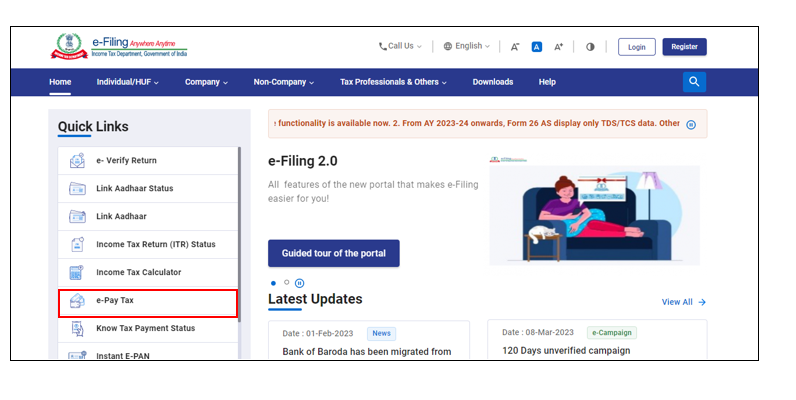

Step 1: Go to the e-Filing portal www.incometax.gov.in and click e-Pay Tax.

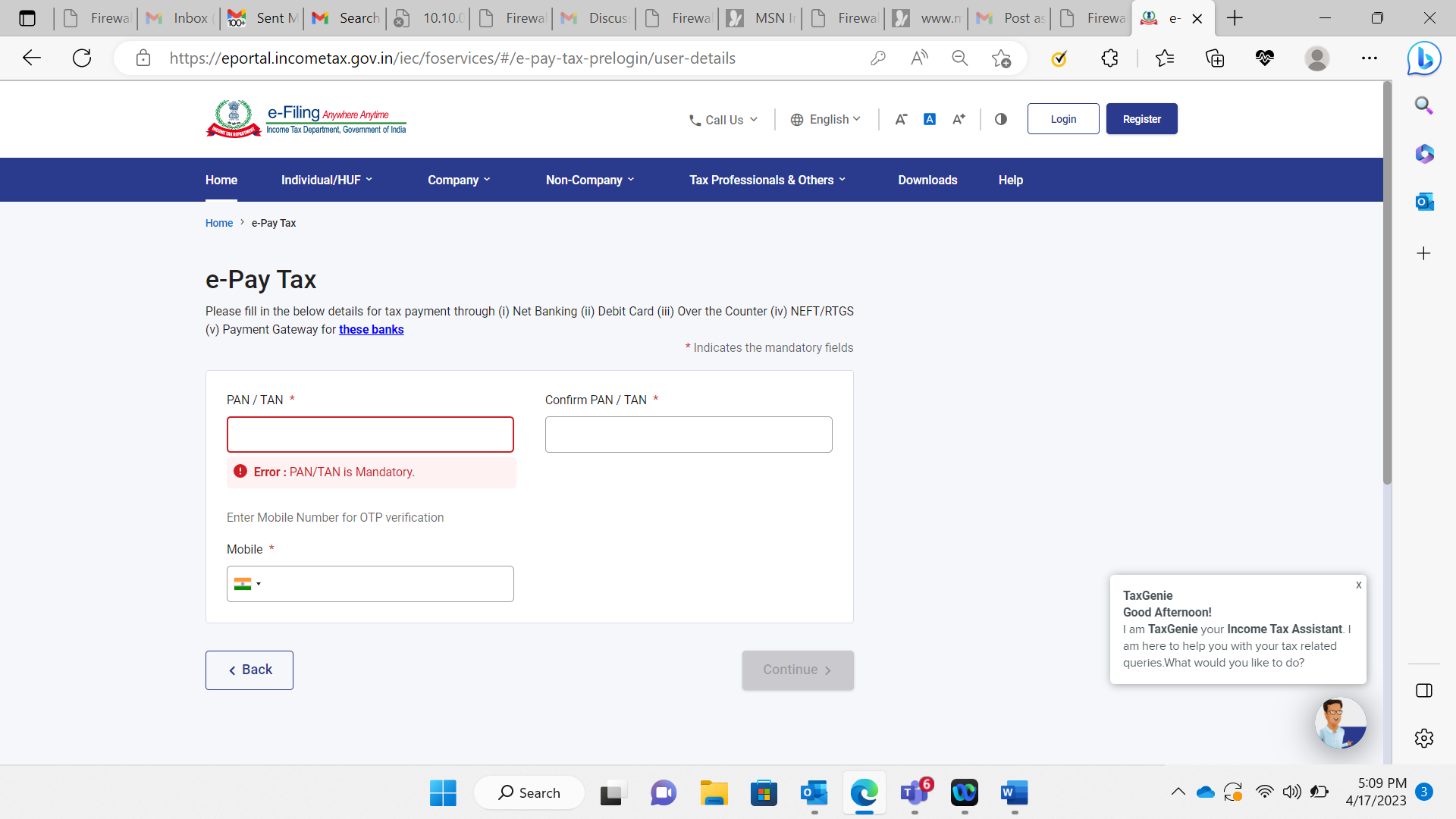

Step 2: On the e-Pay Tax page, fill the and click Continue.

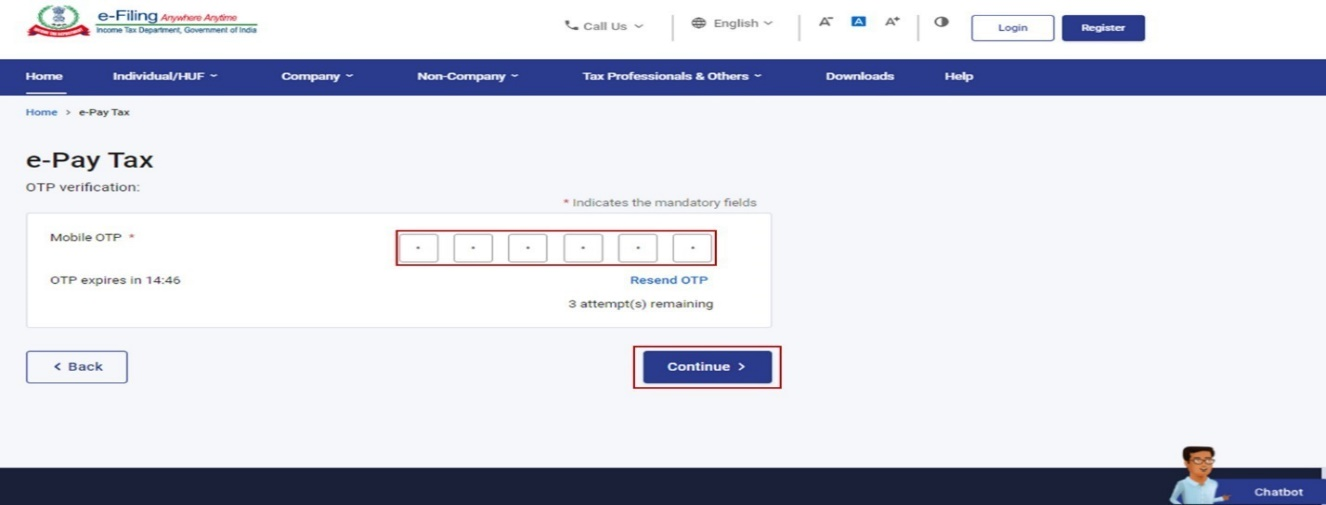

Step 3: On the OTP Verification page, enter the 6-digit OTP received on the mobile number entered in Step 2 and click Continue.

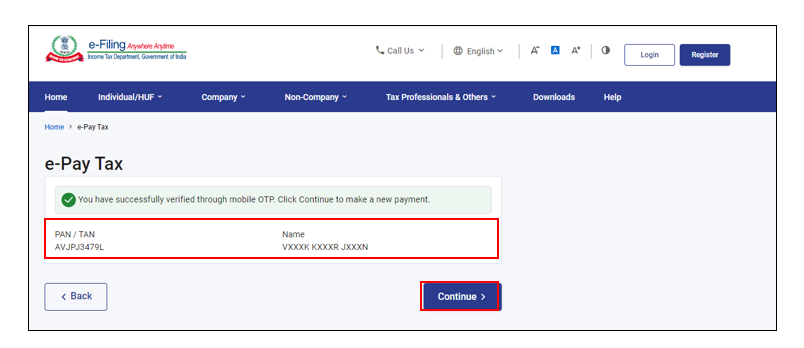

Step 4: After OTP verification, a success message with your PAN/TAN and masked name will be displayed. Click Continue to proceed.

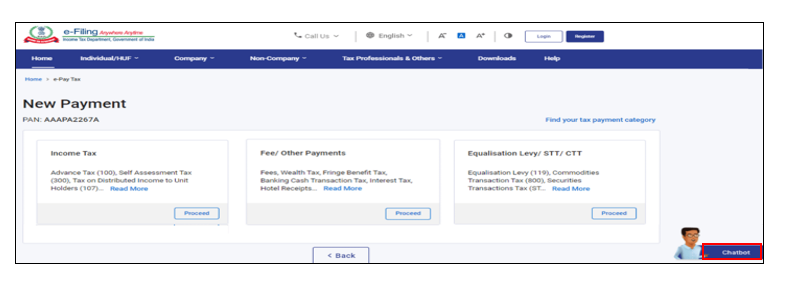

Step 5: On the e-Pay Tax page, click Proceed on a tax payment category that applies to you.

Step 6: After selecting the applicable Tax Payment tile, select Assessment Year, Minor head, other details (as applicable) and click Continue.

Step 7: On the Add Tax Breakup Details page, add the breakup of total amount of tax payment and click Continue.

Step 8: In the Select Payment Mode page, select Payment Gateway mode and click Continue.

Step 9: In the Preview and Make Payment page, verify the details and tax break up details and click Pay Now.

Note: After successful payment, you will receive a confirmation e-Mail and an SMS on the e-Mail ID and Mobile number registered with the e-Filing portal. Once the payment is successful, Challan Receipt may be downloaded for future references. The details of payment and Challan Receipt are also available under Payment History tab on the e-Pay Tax page post-login