Certificate Course on Accounting & Finance

This course will introduce you to the exciting world of finance and provide you with key accounting knowledge and skills. In this course we do not teach you basics of Accounting Concept but how to do the entries and work fluently in the latest and most preferred Accounting Softwares in India.

What You'll Learn:

→ Working Experience in Tally

→ Working Experience in Busy

→ Working Experience in Zoho

→ Working Experience in Quick Books

→ Working Experience in Marg

Accounting Certification Course Highlights

| Full Form | Certificate in Accounting |

| Course Level | Certification |

| Duration | 8 to 10 Sessions |

| Eligibility | Qualifying 10+2 level |

| Admission Process | Based on Merit |

| Average Course Fees | INR 7,000 to INR 20,000 |

| Average Salary | INR 2-4 LPA |

| Top Job Positions | Accounts Assistant, Accounts Manager, Corporate Analyst, Financial Controller, Financial Analyst, etc. |

| Top Recruiting Areas | Banks, Accounting Firms, Financial Firms, Auditing Firms, Corporates, etc. |

Course Content or Sessions:

Benefits of the Course:

- Training: Two-way Live Online Interactive Classroom Sessions (Morning or Evening)

- Projects: Facility to undergo projects in GST, Advanced Excel, HR Payroll, and more

- Internship: Internship Assistance to gain practical experience in the learning

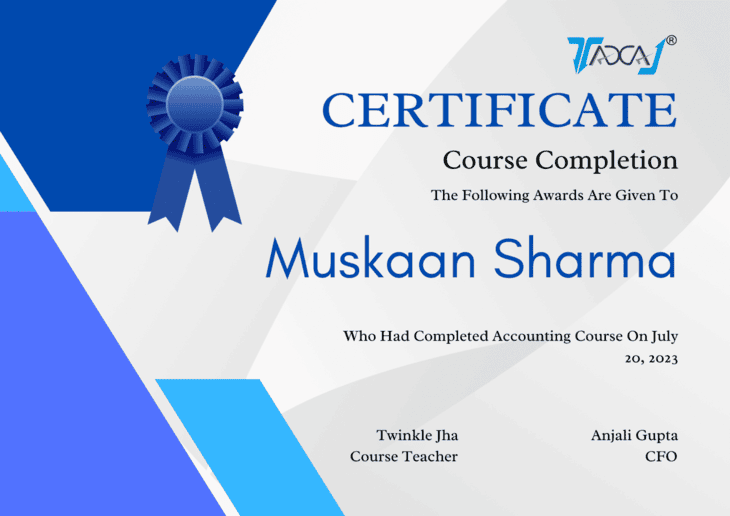

- Certification: Get Certification of Certified Business Accounting & Taxation Course from TAXAJ®, One of the Leading Financial Consulting Firm Globally.

- Placement: 100% Placement Support for 1-Year post successful completion

- E-Learning Access with Abundant Tools and Techniques, video content, assessments, and more

Trainers at TAXAJ Academy:

Trainer 1 : FCS Anjali Gupta

Qualification: She is a Company Secretary and commerce graduate from Delhi University.

Key Strength:

- Indirect Taxation viz GST, DVAT, Customs, and Excise, etc., Company Law, Intellectual Property Law, LLP, Insolvency and Bankruptcy

- Direct Taxation viz Income Tax, etc

- Anjali Gupta is having 6+ years of experience including almost 4 years of consultancy In Secretarial Filings.

- She has worked in a number of domains such as Consultancy, Advisory, Litigation, and analysis in the field of Direct & Indirect Taxation.

- She is currently working as a partner in a reputed consultancy firm located in Delhi NCR Region.

- In her current role, she provides consultancy/advisory services after thoroughly analyzing models of business houses and providing solutions to the respective management.

- She is an expert in the field of litigation in Indirect, Direct Taxes, and Company matters and has presented cases against various Tax Authorities as well.

Training Expertise:

- She delivers training sessions on GST, Income Tax and Company Law Matter resolved numerous doubts for students.

- She also conducts various seminars/sessions where she interacts with students and professionals to guide them through the complex provisions of various Laws.

Trainer 2 : FCA Abhilesh Jha

Qualification: He is a commerce graduate from Calcutta University with a Chartered Accountancy background from the Institute of Chartered Accountants of India.

Key Strength:

- Indirect Taxation viz Service Tax, GST, DVAT, Customs, and excise, etc.

- Direct Taxation viz Income Tax, Wealth Tax, Capital Gains Tax, etc.

- He is having 8 years of experience including almost 4 years of consultancy In GST, FDI, Income Tax.

- He has worked into a number of domains such as Consultancy, Advisory, Litigation, and analysis in the field of direct & indirect taxation.

- He is currently working as CEO in TAXAJ located in Delhi NCR Region.

Training Expertise:

- Highly capable of providing strategic advisory, tax planning on GST, and other indirect taxation, compliance management, litigation operations, departmental representation, filing appeals, and several others

- Excelled at leading indirect tax planning, reporting, and compliance efforts for domestic & cross border operations; proficient in minimising company’s tax exposure while ensuring compliance with all applicable laws and regulations

Trainer 3 : Shivesh Jha

Qualification: He is a commerce graduate from Calcutta University and currently pursuing L.L.B.

Key Strength:

- He is having 15 years of experience including almost 4 years of consultancy in Legal Matters

- He has worked into a number of domains such as Consultancy, Advisory, Litigation, and analysis in the field of direct & indirect taxation.

- He is currently working as Legal Head in TAXAJ located in Delhi NCR Region.

Training Expertise:

- Highly capable of providing strategic advisory, litigation operations, departmental representation, filing appeals, and several others.