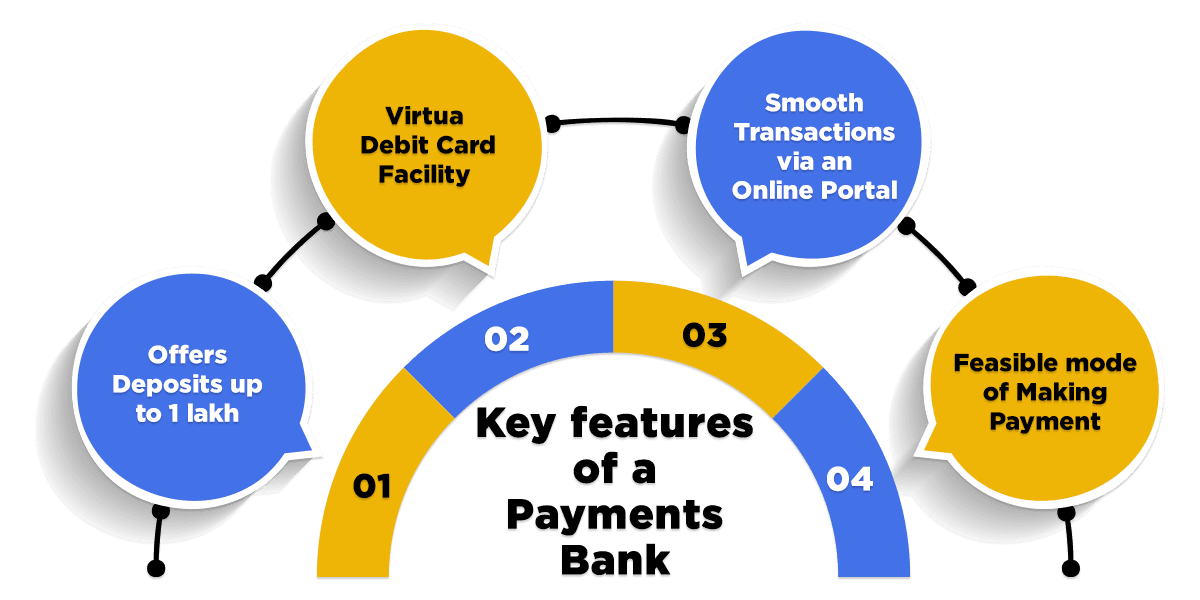

Payment Bank is allowed by the Reserve Bank of India (RBI). The most deposits confined to these types of Bank currently is INR 1 lakh per client, which can be enhanced further in near future. Both the current and savings account can be run under such Bank. The payments bank will be enrolled as a public limited company under the Companies Act, 2013, and authorized under Section 22 of the Banking Regulation Act, 1949, with particular licensing limitations restricting its activities largely to acceptance of demand deposits and provision of payments and its services.

They can allot service linking to debit cards, online banking, mobile banking and also ATM cards. Payment Bank, will be allowed to set up outlets (branches), ATMs, business correspondence, etc. But will be restricted to activities authorized to Bank under the Banking Regulation Act, 1949. The minimum paid-up capital of the payment bank shall be 100 crores. These Payment banks are licensed and certified under the regulatory body. TAXAJ will simplify your licensing procedure by offering services in Delhi NCR, Gujarat, Mumbai, Bengaluru, Chennai & all other Indian cities.

Get your payments bank license registered in the fastest possible manner.

It usually takes 25 to 35 working days, depending upon government approval.

👉 Incorporation of a Public Limited Company. Click Here

👉 Filing of application to RBI: Filing of application to Chief General Manager of the RBI (Reserve Bank of India)

👉 Evaluation of Application: EAC (External Advisory Committee) must assess the application & call for information and inquiries with the applicant.

👉 Granting License: RBI license must be given who satisfies all the eligibility criteria for payment bank licenses.

👉 Online Review of license: The name of applicants for bank licenses must be displayed in the official RBI site.

👉 RBI Approvals : In-principle approval to run a bank shall be taken up by RBI. The bank requires to be set up in a time period of 18 months.

- Businesses looking to expand or scale operations on higher level

- Startups looking to raise capital and issue ESOPs

- Businesses aiming to work globally or with reputed clients

DSC Application

Name approval form filing

Preparation of Incorporation Documents

Getting those docs signed by the respective stakeholders

Filing of e-Forms with ROC

Receipt of Incorporation Certificate with PAN, TAN, GST, EPF, ESI & Bank Account.

Name, Contact Number and Email Id of all the Stakeholders.

Directors Identification Number, if already.

Self Attested PAN, Aadhar & Passport size photo of all the Stakeholders.

Apostilled Passport, Mobile Bill and other KYC docs in case of NRI Stakeholder.

Latest Month Personal Bank statement of all the Stakeholders.

Specimen Signatures of all Stakeholders.

Few Proposed Business Names along with Objects.

Latest Electricity Bill/Landline Bill of Registered Office.

NOC from owner of registered office. (If Owned)

Rent Agreement from Landlord. (If Rented/Leased)

Brief description of main business activities of the proposed Company.

Shareholding pattern (50:50 or 60:40) between the Stakeholders.

Authorised & Paid Up Share Capital of the Company.

Payments Bank License Explained in this short video

Benefits of Payments Bank

Regulatory Acts which oversees Payments Bank

A Payment Bank must get enrolled under these Government Acts and the payments bank license is given by the compliance of these acts.

👉 Companies Act, 2013

👉 Reserve Bank of India Act, 1934

👉 Banking Regulation Act, 1949

👉 Payment and Settlement Systems Act, 2007

👉 Foreign Exchange Management Act, 1999

👉 Deposit Insurance and Credit Guarantee Corporation (DICGC) Act, 1961

Eligibility for Payments bank Licensing

The RBI has laid down a long list of qualified players for Payment Bank license as it needs a least paid-up capital of 100 crores. Let’s see who can apply for a Payment Bank License:

👉 All Existing issuers of non-bank Prepaid Payment Instrument (PPI) approved under the Payment and Settlement Systems Act, 2007

👉 Non-Banking Finance Companies (NBFCs)

👉 Professionals or any Individuals

👉 Corporate Business Correspondents (BCs)

👉 Supermarket Chains

👉 Public Sector Entities

👉 Real Sector Cooperatives owned by residents

👉 Mobile Telephone Companies

👉 Companies (Public companies)

👉 Also, a promoter or group of promoters can be available for the Payment Bank License if he/she has a Joint Venture with a current scheduled commercial bank.

Objectives of Payment Bank

There is a requirement for transactions and savings accounts for the under-served people. Payments have macro-economic advantages for the region, supporting those even micro-economic advantages to the recipients—higher transaction charges of making payments reduce these benefits. Hence, the primary purpose of setting up payment banks will be to moreover financial inclusion by giving. Small savings accounts and Payments/remittance services to migrant labour workforce, low-income households, small businesses, other random sector entities, and other users, allowing significant volume-low value transactions in deposits and payments/ remittance services in a settled technology-driven environment.

Capital Requirement

📢 Payments bank must have a leverage ratio of not less than 3 percent, i.e., its external liabilities must not pass 33.33 times its net worth (paid-up capital and reserves). Promoter’s contribution: The promoter’s least first contribution to the paid-up equity capital of such payments bank must at least be 40 % for the first 5 years from the start of its business.

📢 These banks must have a huge powered Customer Grievances Cell to manage customer complaints.

📢 The least paid-up equity capital for payments banks must be Rs. 100 crore.