Surrender Employee State Insurance (EPF) License

Employees State Insurance is governed under ESI Act. It is utmost important to officially surrender your ESI number in order to safeguard yourselves from the penalties imposed by law.

Not using your ESI Registration or closed down your business? You need to Surrender the ESI Registration

It usually takes several months for ESI Officer's Approval, if they find everything in order.

- Eligibility Consultation

- Preparation of documents

- Filing of Application for Surrender / Cancellation for 1 ESI

- Business Hour CA Support

- All entities who want to cancel ESI Registration

- Purchase of Plan

- Upload documents

- Filing of application

- Getting ESI Closed

- 01. Affidavit from all the directors for any future liability

- 02. Return of I.T. dept. till the date of closure;

- 03. Return of GST;

- 04. Telephone connection surrender;

- 05. Closing of Bank Account;

- 06. In case of Company, intimation to Registrar of Companies (ROC);

- 07. Surrender of Trading Licence ,if any

- 08. Dissolution of rental deed, lease deed etc;

- 09. Any other relevant documents for the same, if any

All you need to know about Surrendering the EPF & ESI Number in India.

Applicability of ESI Scheme

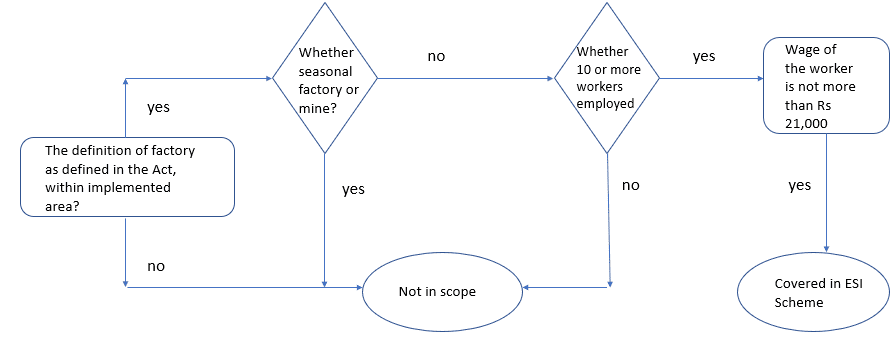

The ESI scheme is applicable to all factories and other establishments as defined in the Act with 10 or more persons employed in such establishment and the beneficiaries’ monthly wage does not exceed Rs 21,000 are covered under the scheme. Whether the employer has employed 10 or more employees, all employees employed by the employer, agnostic of the salary are reckoned. The applicability of the scheme is explained through a flow chart below:

Note: The scheme under the act also supports restaurants, motor road transports, newspaper establishments and undertakings, movies and purview theatres, hotels, shops. The threshold for coverage of establishment is 20 employees in Maharashtra.

Features of ESI Scheme

- Complete medical care and attention are provided by the scheme to the employee registered under the ESI Act, 1948 at the time of his incapacity, restoration of his health and working capacity.

- During absenteeism from work due to illness, maternity or factories accidents which result in loss of wages complete financial assistance is provided to the employees to compensate for the wage loss.

- The scheme provides medical care to family members also. As of 31 March 2019, 3.14 crore employees are covered under this scheme with the total number of beneficiaries summing up to 13.32 crore.

- Broadly, the benefits under this scheme are categorized under two categories:

- Cash benefits (which includes sickness, maternity, disablement (temporary and permanent), funeral expenses, rehabilitation allowance, vocational rehabilitation and medical bonus) and,

- Non-cash benefits through medical care.

- The scheme is self-financing and being contributory in nature. The funds under the ESI scheme are primarily built out of the contribution from the employees and employers payable monthly at a fixed percentage of wages paid.

- Currently, the employee contribution rate is 0.75% of the wages and that of employers is 3.25% of the wages paid.

- The employer makes the contribution from his own share in favour of those employees whose daily average wage is Rs 137 as these employees are exempted from his own contribution.

- The employer is required to pay his contribution and deduct employees’ contribution from wages and deposit the same with ESIC within 15 days from the last day of the calendar month in which the contribution falls due. The payment can either be done online or through designated and authorized public sector banks.

ESI Contribution Rates

| ESIC contribution rates (Reduced w.e.f. 01/07/2019) |

| Particulars | Current Rate | Reduced Rate |

| Employer Share | 4% | 3.25% |

| Employee Share | 1% | 0.75% |

| Total | 5% | 4% |