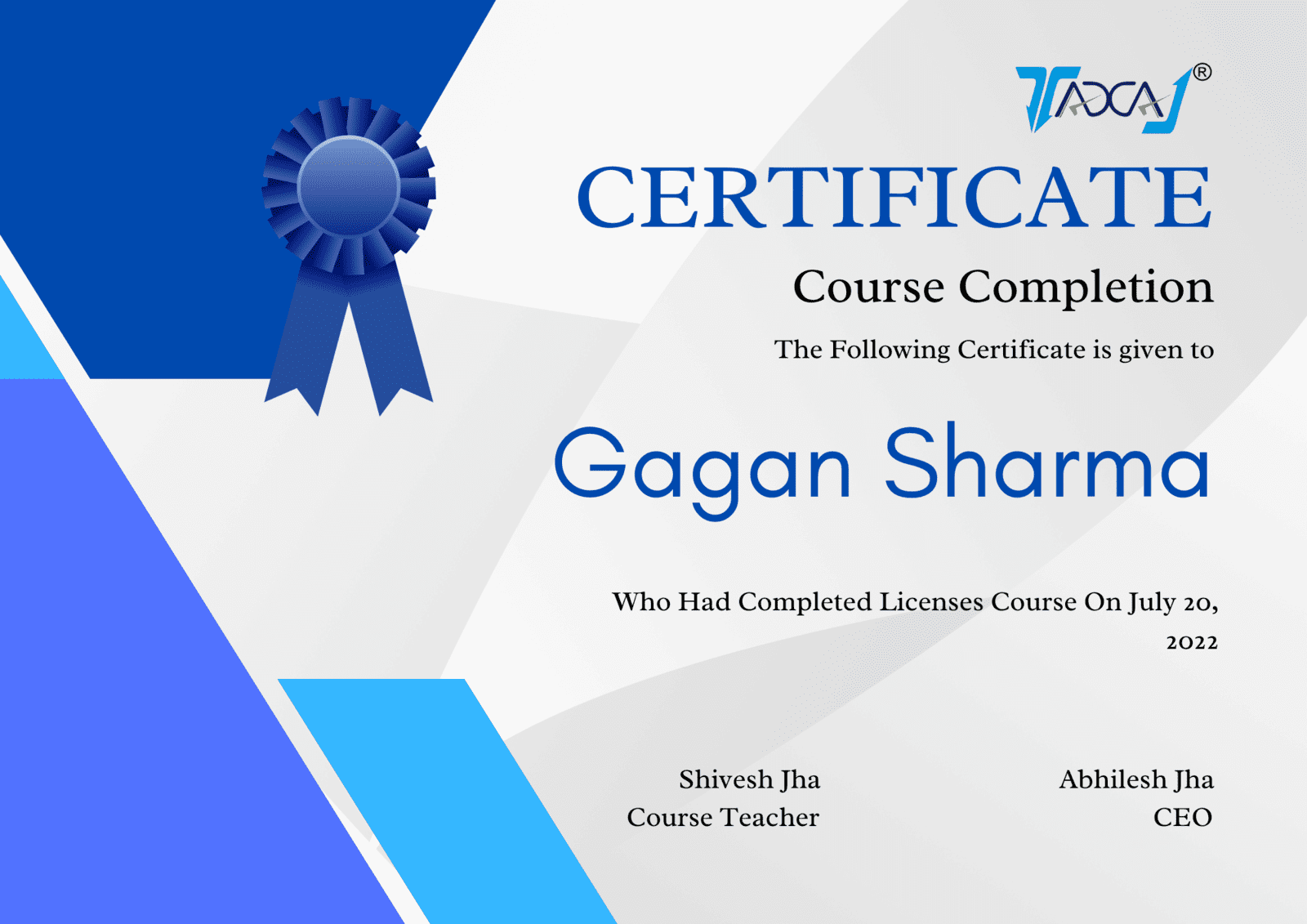

Certificate Course on Licenses & Registrations

This certificate course helps you gain knowledge about various Registrations & Licenses in India that are applicable for companies depending upon their nature of business model. After completion of this course you can easily register for any type of licenses that we cover in this course module.

InDirect Tax Certification Course Highlights

| Full Form | Certificate in Registration & Licenses |

| Course Level | Certification |

| Duration | 10 to 15 Sessions |

| Eligibility | Qualifying 10+2 level |

| Admission Process | Based on Merit |

| Average Course Fees | INR 10,000 to INR 15,000 |

| Average Salary | INR 2-4 LPA |

| Top Job Positions | Accounts Assistant, Finance Manager, Corporate Analyst, Financial Controller, Tax Analyst, etc. |

| Top Recruiting Areas | Banks, Accounting Firms, Financial Firms, Auditing Firms, Corporates, etc. |

Course Details & Sessions

Benefits of the Course:

Learn basics of GST.

Get complete understanding of GST registration process and return filing steps & procedure.

Learn how to extract data from Tally for the various return filing.

Business owners can do registration and file their GST return by their own.

Explanation on how to rectify some common errors encountered while filing the GST returns will assist the accountants in their job role.

Increases the job opportunities for newly passed out graduates and also for all others with the knowledge of practical aspects of GST.

On completion of this course, you will get a course completion certificate and a good understanding of theoretical as well as practical angle of GST and you will be GST ready for coming future. So hurry up and enroll now!!!

Course Trainer: FCA Abhilesh Jha

Qualification: He is a commerce graduate from Calcutta University with a Chartered Accountancy background from the Institute of Chartered Accountants of India.

Key Strength:

- Indirect Taxation viz Service Tax, GST, DVAT, Customs, and excise, etc.

- Direct Taxation viz Income Tax, Wealth Tax, Capital Gains Tax, etc.

- He is having 8 years of experience including almost 4 years of consultancy In GST, FDI, Income Tax.

- He has worked into a number of domains such as Consultancy, Advisory, Litigation, and analysis in the field of direct & indirect taxation.

- He is currently working as CEO in TAXAJ located in Delhi NCR Region.

Training Expertise:

- Highly capable of providing strategic advisory, tax planning on GST, and other indirect taxation, compliance management, litigation operations, departmental representation, filing appeals, and several others

- Excelled at leading indirect tax planning, reporting, and compliance efforts for domestic & cross border operations; proficient in minimising company’s tax exposure while ensuring compliance with all applicable laws and regulations